Let’s be honest, price increases are never welcome, especially in an economy where many people are already tightening their belts. With rising living costs and household budgets stretched thinner than ever, many South Africans are re-evaluating their healthcare cover. So, when contribution increases are announced, it can feel overwhelming.

Then why do medical aids need to increase contributions at all? Our members deserve transparent answers.

“The truth is that several real-world pressures are pushing healthcare costs upward. What matters is how medical schemes manage these pressures to keep increases as low and sustainable as possible.”

– Shabana Patel, Senior Manager of Data Strategy

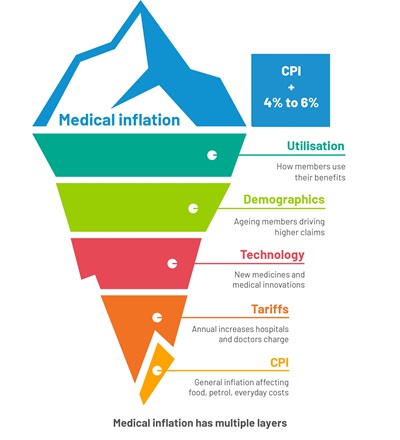

The building blocks of medical inflation

Part of the answer starts with inflation. The most familiar indicator of inflation is the consumer price index (CPI).

|

|

Medical inflation begins here too. CPI sets the baseline for what hospitals and doctors can charge each year, forming the foundation of annual tariff increases. But unlike everyday inflation, several additional layers drive medical costs and ultimately shape contribution increases.

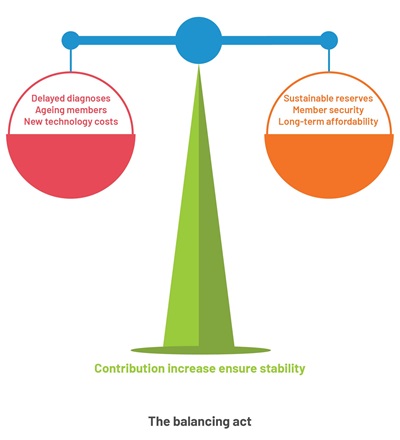

Contribution increases are necessary for sustainability

Apart from the factors above, schemes need to take additional factors into account to keep benefits sustainable when calculating annual contribution adjustments.

“Strong reserves protect our members against uncertainty and ensure Medihelp remains resilient in any environment,” states Werner van Deventer, Head of Business Development.

|

This slowed reserve growth, but it protected members when they needed it most. While this provided critical relief, it created a gap that required careful realignment. Today, the scheme is returning to the required 25% solvency level sooner than expected, strengthening protection against future uncertainty. |

- Maintaining adequate reserves: Schemes must build and protect reserves to cushion against unexpected events – from pandemics to sudden spikes in claims.

- Scheme-specific risk pools: Each scheme has its own claims experience, demographics, negotiated hospital tariffs, and utilisation patterns, leading to variations in contribution needs across the industry.

- Community rating: By law, medical schemes cannot charge different premiums based on age or health status. Contributions may only differ by option, family size, or income. This ensures fairness, but it also means that rising claims must be shared across the entire member base.

Why do medical scheme increases vary?

Medical schemes don’t operate in identical environments. The industry average sits at around 8% for 2026, but individual schemes increases vary widely (from 4,7% to 19,15%) based on their unique circumstances, for example:

- Its own risk profile, which includes member age, family size, and chronic illnesses

- Different hospital and specialist tariffs negotiated individually

- Unique claims trends influenced by utilisation and disease patterns

- Their own benefit design decisions, upgrades, and enhancements

|

|

Medihelp’s weighted average contribution increase is 8,46% for 2026, with most members seeing increases of 7,5% or less. This reflects responsible pricing that considers real claims trends, benefit design, and the long-term sustainability of each plan.

|

|

Prevention: The long game

“By investing in prevention and predictive health, we’re lowering future costs and improving outcomes for our members.”

– Shabana

Medihelp’s focus on prevention through facial scanning kiosks, home monitoring devices, and personalised care pathways isn’t just about better health but also about managing costs sustainably while enhancing your care experience.

.jpg?sfvrsn=ed63b1f4_2&MaxWidth=400&MaxHeight=445&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=5131084878C64692A77AB9692118307A134F5B21)

Predictive healthcare, digital tools, and integrated care initiatives (like Medihelp’s post-hospital care programme) help:

- Identify risk earlier

- Prevent complications

- Reduce unnecessary readmissions

- Improve outcomes

This means healthier members and a more stable, affordable medical scheme for everyone.

Want to find out more about our benefit enhancements for 2026? Watch our video below:

The bottom line

Contribution increases aren’t about profit – in fact, medical aids are non-profit organisations. Every contribution increase decision prioritises one thing: ensuring Medihelp can deliver when you need us most. Increases are about ensuring that every member in every life stage, from student to retiree, has access to quality care when it matters most.

The healthcare industry recognises that significant increases aren't sustainable in the long term. These short-term adjustments are rebuilding the foundation for more stable, moderate increases in the coming years. As reserves strengthen and loss-making plans stabilise, we expect contribution increases to normalise.

By managing inflation pressures, protecting reserves, and innovating prevention and value, Medihelp continues to deliver affordable, sustainable healthcare for all our members.

For 120 years, Medihelp has balanced care with discipline, humanity with strategy. Your contribution isn't just a payment, it’s an investment in healthcare that adapts, protects, and grows with you.

Written by Shabana Patel, Senior Manager of Data Strategy, and Werner van Deventer, Head of Business Development